Thinking about investing in the Bank of Montreal (BMO)?

Before we jump in, let’s make sure you have all the information you need to make smart decisions. This article will give you the basics of buying BMO stock, plain and simple.

First off, know the stock price history, find out Bank of Montreal’s (BMO) current stock price on platforms like IFC Markets. Check out BMO’s past performance to see how the stock has moved over time. This can help you understand its ups and downs, and its potential for future growth.

Set your goals, why are you buying BMO? Do you want to make quick profits, build wealth over time, or get regular income from dividends? Knowing your goals will help you choose the right approach.

- Don’t put all your eggs in one basket! Spread your investments across different companies and types of assets to reduce risk.

- Use strategies like stop-loss orders and dollar-cost averaging to manage your risk and protect your money.

Follow BMO’s official news for updates on important events like mergers, acquisitions, and new strategies, also keep an eye on BMO’s financial results (like earnings reports) to see how the company is doing. And last but not least, pay attention to what’s happening in the economy and financial markets, especially things that might affect banks like BMO.

Choose Your Platform

Compare different stock trading platforms like IFC Markets to find one that fits your needs. Consider things like fees, research tools, and how easy it is to use. Many platforms offer demo accounts, so you can practice trading with fake money before you invest real cash.

Understanding Bank of Montreal (BMO) Stocks

BMO is a well-positioned bank with a diversified business model and strong growth potential. Recent developments like the U.S. expansion and focus on digitization could go well for its future performance.

Position in the Industry:

● 8th largest bank in North America by assets.

● Strong presence in Canada and the U.S., serving 13 million customers.

● Diversified business, offering personal and commercial banking, wealth management, global markets, and investment banking services.

Core Business Areas:

● Personal and Commercial Banking: Accounts for a significant portion of revenue, providing chequing and savings accounts, loans, and credit cards.

● Wealth Management: Offers high-net-worth individuals and families investment advice, estate planning, and other financial services.

● Global Markets: Facilitates trades in currencies, commodities, and other securities for institutional clients.

● Investment Banking: Provides financing and advisory services for mergers and acquisitions, public offerings, and other corporate transactions.

Recent Developments:

BMO invests heavily in online and mobile banking platforms to improve customer experience and accessibility. Acquired Bank of the West in 2022, which increased its footprint in the U.S. market. Also, the Bank of Montreal is setting an ambitious goal for reducing greenhouse gas emissions and supporting green initiatives.

Potential Impact on Stock Performance:

● U.S. expansion success: Integration of the Bank of the West will be crucial for future growth and profitability.

● Economic conditions: Rising interest rates may benefit BMO’s net interest income, but a potential recession could hurt loan demand.

● Competition: BMO faces competition from other major banks and fintech companies.

Stock Price History

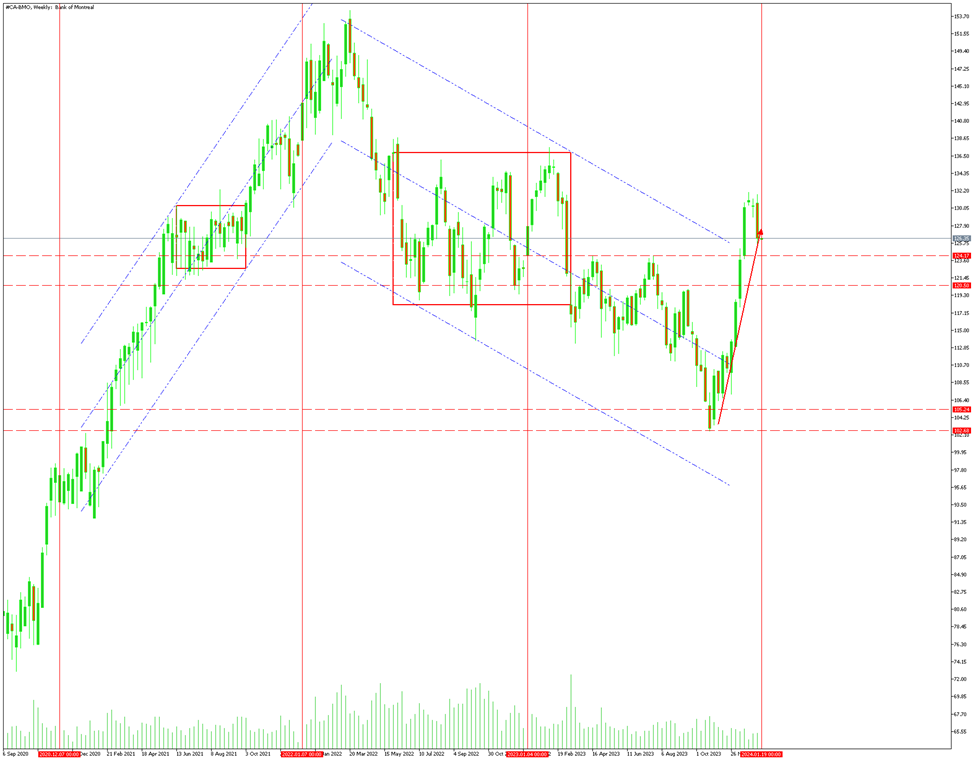

Bank of Montreal (BMO) stock has experienced ups and downs over the past 3 years, influenced by various economic, industry, and company-specific events. Here’s a timeline with key highlights:

2021:

- Bullish start. BMO stock climbed steadily in the first half due to low-interest rates and economic recovery optimism.

- Peak in June. Reached an all-time high of $130.01 in June, driven by strong financial results and positive market sentiment.

- Correction till late September. Concerns about rising inflation and potential interest rate hikes triggered a volatility in rectangular channel thought, then the price steadily raised till the end of the year.

2022:

- The year started with the continuation of the uptrend till late March also increased market uncertainty due to inflation concerns and the Ukraine war, set off the downtrend till the end of August.

- The stock price fluctuated between $117 and $136, with both bearish and bullish periods.

- The announcement of the Bank of the West acquisition boosted the stock in the short term while rising interest rates later in the year put downward pressure.

2023:

- Mixed performance: The stock initially started with an uptrend to a 24-week high of $135 in February due to broader market trends.

- The stock price fluctuated between $114 and $124, with both bearish and bullish periods, with a slight downtrend hitting the lowest price at the end of October at $102.

- The closing of the year was marked with a sharp uptrend from $102 to $124.

Significant events and their impact

- The COVID-19 pandemic: Initially caused uncertainty and volatility, but BMO’s resilience and strong performance during the pandemic helped stabilize the stock.

- Interest rate hikes: Rising interest rates in 2022 and 2023 initially put downward pressure on the stock, but could later benefit BMO’s net interest income.

- Bank of the West acquisition: This major expansion into the U.S. market has the potential to drive future growth but also carries integration risks.

- Economic conditions: The potential for a recession remains a concern for the stock market in general, including BMO.

Tips for Buying Bank of Montreal (BMO) Stocks:

1. Research and Due Diligence:

Before starting to think of trading BMO CFDs or investing in, thorough research is what you have to do.

- Assess BMO’s profitability, revenue streams, debt levels, and growth prospects.

- Understand the overall banking landscape, economic factors, and any regulatory changes impacting the sector.

- See how they stack up against other major banks in terms of performance, valuation, and market share.

- Gain insights from financial analysts who follow BMO and provide recommendations.

2. Setting Investment Goals:

Know your “why” before you commit. Are you in for short-term gains, long-term wealth building, or income generation through dividends? Clearly defined goals will guide your investment decisions and risk tolerance.

3. Risk Management Strategies:

BMO might seem like a “safe” bet, but remember, all investments carry risk. Employ these strategies to mitigate potential losses:

- Diversification: Don’t put all your eggs in the BMO basket. Spread your investment across different sectors and asset classes.

- Stop-loss orders: Set a price point at which your BMO shares automatically sell if they fall below a certain threshold.

- Dollar-cost averaging: Invest a fixed amount at regular intervals to reduce the impact of market volatility on your average purchase price.

4. Stay Informed with Stock News:

Keep your finger on the pulse of BMO-related news

- Monitor BMO’s financial performance quarterly and annually.

- Stay updated on mergers, acquisitions, executive changes, and any strategic initiatives.

- Follow financial news outlets and expert commentary on the banking industry and broader economic trends.

5. Utilize Stock Trading Platforms:

Choose a reputable and user-friendly platform to execute your BMO trades.

Commission fees: Compare platforms to find one with competitive fees for stock transactions.

Research tools and resources: Choose a platform offering fundamental and technical analysis tools to aid your decision-making.

Ease of use: Select a platform with a user-friendly interface and clear instructions for placing trades.

Conclusion

Investing in the Bank of Montreal (BMO) can be a wise move for someone seeking a well-established bank with solid growth potential. However, it’s crucial to approach any investment with a clear head and a well-thought-out plan.

Always remember to

- Do your research: Understand BMO’s financial health, industry trends, and potential risks.

- Set realistic goals: Know what you want to achieve with your BMO investment and tailor your strategy accordingly.

- Manage risk: Don’t put all your eggs in one basket and utilize risk mitigation strategies like diversification and stop-loss orders.

- Stay informed: Keep up with BMO news, industry developments, and economic trends that might impact your investment.

- Choose the right platform: Find a reputable and user-friendly platform that fits your needs and budget.

Trading stocks is a marathon, not a sprint. Stay informed, make informed decisions, and adapt your strategy as needed.

Good Luck!