Bausch Health Companies Inc. (NYSE: BHC) is a global company that develops, manufactures, and markets a range of pharmaceutical, medical device, and over-the-counter products, primarily in the therapeutic areas of eye health, gastroenterology, and dermatology. The company was formerly known as Valeant Pharmaceuticals International, Inc. and changed its name to Bausch Health Companies Inc. in July 2018. The company operates through five segments: Bausch + Lomb/International, Salix, Ortho Dermatologics, Diversified Products, and Solta.

Bausch Health Companies Inc.: Company Overview

Bausch Health Companies Inc. has a diversified portfolio of products that serve a variety of medical needs.

- Bausch + Lomb/International: Largest segment

- Salix: Second-largest segment

- Ortho Dermatologics: Third-largest segment

- Diversified Products: Fourth-largest segment

- Solta: Smallest segment

Since 2016, Bausch Health Companies Inc. has been transforming to overcome scandals, debts, investigations, and market losses, also has improved its finances and operations by selling off non-essential assets, cutting down debts, settling legal issues, simplifying its structure, and investing in R&D.

The firm has also introduced new products, such as Vyzulta for glaucoma, Bryhali for psoriasis, Bausch + Lomb Infuse for contact lenses, and Nextstellis for contraception, and has obtained regulatory approvals.

Bausch Health Essence

- Vision is to lead in eye health, gastroenterology, and dermatology, and to offer innovative solutions that enhance people’s lives.

- The mission is to grow its main businesses, increase its global reach, diversify its product range, and balance its capital.

- Values are integrity, collaboration, customer focus, innovation, and performance.

Bausch Health Companies Inc. Stock Price in 2024

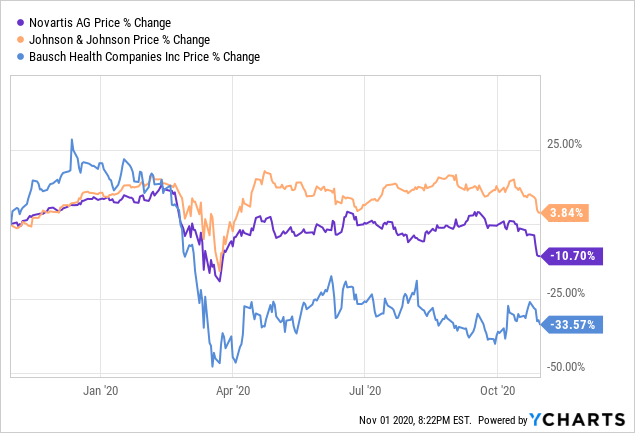

Bausch Health Companies Inc. stock price has been volatile in the past few years, reflecting the company’s challenges and opportunities. stock reached a peak of $263.81 in August 2015, but then plummeted to a low of $8.31 in March 2020, amid the COVID-19 pandemic and the company’s debt woes. The stock has since recovered some of its losses, trading at around $8.51 as of February 16, 2024, with a market capitalization of $3.11 billion.

The stock price has been influenced by several factors

- Company’s earnings results,

- Product launches,

- Debt repayments,

- Legal settlements,

- and market conditions.

The company has reported mixed earnings results in the past few quarters, beating analysts’ expectations in some periods and missing them in others. Also launched several new products:

- Bausch + Lomb Infuse,

- Nextstellis,

- and Duobrii,

which have contributed to its revenue growth.

Bausch Health Companies Inc. has also reduced its debt by $8.5 billion since the end of 2016, improving its liquidity and leverage ratios. Resolved some of its legal issues, such as the Allergan litigation, the Xifaxan patent litigation, and the U.S. Securities and Exchange Commission investigation.

The COVID-19 pandemic has also impacted the business, especially its elective procedures and consumer products, the loss of exclusivity of some of its products such as Zovirax and Uceris has also been impacted by competitive pressures from other players in its markets such as AbbVie, Pfizer and Johnson & Johnson.

Bausch Health Companies Inc.’s stock price is expected to fluctuate in 2024 depending on the company’s performance and market sentiment, of course.

The company provided guidance for 2024 – revenue is expected to range from $8.6 to $8.8 billion, and adjusted EBITDA from $3.4 to $3.55 billion. And cash flow from operating activities is $1.3 billion to $1.5 billion.

Bausch Health Companies Inc. also announced its intention to

- Spin off its Bausch + Lomb eye care division into an independent public company, which is expected to be completed by the end of 2024.

- It will continue to invest in its developments, launch new products, reduce its debt, and take advantage of strategic opportunities.

As of February 16, 2024, the analyst consensus estimate for the stock is $9.50, with a high estimate of $12.00 and a low estimate of $7.00.

Trading Bausch Health Companies Inc. with Trusted Brokerage

Trading Bausch Health Companies Inc. stock is rewarding but risky, as the stock is volatile and uncertain. So, it is important to pick a trustworthy and reliable broker that can offer the best trading conditions, tools, and services. One such broker is IFC Markets, a leading online broker that gives access to over 600 instruments, including stocks, currencies, commodities, indices, and ETFs.

IFC Markets has several benefits for trading Bausch Health Companies Inc. stock:

- Low spreads and commissions: IFC Markets has tight spreads and low commissions for trading stocks, helping investors to save on trading costs and boost their profits.

- Various trading platforms: IFC Markets has different trading platforms, such as NetTradeX, MetaTrader 4, and MetaTrader 5, that work with different devices, such as desktops, laptops, tablets, and smartphones. The platforms have features, such as technical analysis tools, charting options, indicators, and trading signals, that help investors analyze the market and trade.

- Flexible leverage and margin: IFC Markets has flexible leverage and margin options for trading stocks, from 1:1 to 1:40, depending on the instrument and the account type. Leverage and margin can help investors increase their trading exposure and returns, but they also increase risks and losses.

- Portfolio Quoting Method: IFC Markets has a unique feature called the Portfolio Quoting Method, which lets investors create their own synthetic instruments by combining assets, such as stocks, currencies, and commodities. The Portfolio Quoting Method can help investors diversify their portfolios, hedge their risks, and use arbitrage opportunities.

- Educational and analytical resources: IFC Markets has various educational and analytical resources, such as articles, videos, webinars, books, and courses, that help investors to learn and improve their trading skills and knowledge. The broker also has market news, economic calendar, trading signals, and technical analysis, that help investors to stay updated and informed about the market trends and events.

To trade Bausch Health Companies Inc. stock with IFC Markets, you need to do these steps:

- Register an account with IFC Markets by filling out the online form and verifying your identity and address.

- Choose the account type that fits your trading style and preferences, such as Standard, Micro, or VIP.

- Deposit funds into your account using payment methods, such as bank transfer, credit card, or e-wallet.

- Download and install the trading platform of your choice, such as NetTradeX, MetaTrader 4, or MetaTrader 5.

- Search for Bausch Health Companies Inc. stock in the platform’s market watch and add it to your favorites.

- Open a buy or sell position based on your market view and trading strategy, and set your stop loss and take profit levels.

Bausch Health Companies Inc. Stock Price Forecast

Bausch Health Companies Inc. stock price forecast is based on various factors

- The company’s fundamentals,

- Industry trends,

- Market sentiment,

- Technical analysis

The forecast is not a guarantee of future performance, but rather an estimation of the possible scenarios and outcomes.

Surely the forecast is subject to change depending on the new information and events that may affect the stock price. Therefore, you should always do your own research and analysis before making any trading decisions.

The forecast shows that

- The stock price is expected to increase gradually over the next year, reaching $12.25 by February 2025.

- The stock price has a wide range of possible outcomes, with a high estimate of $17.50 and a low estimate of $7.00, indicating a high degree of uncertainty and volatility.

The prediction is based on the assumption that the company will continue to execute its growth strategy, launch new products, reduce its debt, and complete its spin-off plan and that the market will react positively to these developments.

The forecast is based on the assumption that the company will not face any major setbacks, such as adverse regulatory actions, legal disputes, product failures, or competitive threats, and that the market conditions will remain favorable for the industry and the sector.

Conclusion

Bausch Health Companies Inc. (BHC) has undergone a significant transformation since 2016, overcoming challenges to emerge as a player in eye health, gastroenterology, and dermatology. While its stock remains volatile, positive developments suggest potential for future growth.

Key Points:

- Company Overview: Diverse product portfolio across key therapeutic areas.

- Challenges: Past scandals, debt, and legal issues.

- Transformation: Divestments, debt reduction, R&D investments, new product launches.

- Vision & Mission: Leading in healthcare through innovation and expansion.

- Stock Price: Recovered from lows, but remains volatile.

- Analyst Consensus: $9.50 target price, with a Buy rating due to growth prospects.

- Risks: COVID-19 impact, patent expirations, legal issues, competition.

- Forecast: Gradual increase to $12.25 by February 2025, with wide uncertainty.

Overall, Bausch Health presents an intriguing investment opportunity, but significant risks remain. Investors seeking high growth potential with a tolerance for volatility may consider BHC, while others may prefer less risky options. Always do your due diligence before trading.

Good Luck!